By: Aaron Puthan

What is the Fed’s toolkit in the case of a future economic downturn?

The Fed couldn’t stay out of the spotlight for over the past two years; they hiked nine times from 2015 to 2018 amid a strong economic backdrop. However, as the tide turned and growth weakened, the Fed pivoted to cut interest rates three times in 2019. Since its latest cut in August of 2019, the Fed has remained on hold in a policy rate range between 1.5% and 1.75%. The easier monetary policy stance helped support assets, with the S&P 500 returning over 30% in 2019.

Watching the Fed Closely

Last week Tuesday, Federal Reserve Chairman Jerome Powell headed to Capitol Hill for his two day testimony. The agenda focused on current policy, as well as debating on how the central bank might respond to new economic uncertainties arising in China. Below, we hone in on a few talking points.

1) Remind me, what are the Fed’s goals? Are they achieving them?

The Fed has a dual mandate. This means having an objective to maintain:

1) maximum employment

2) stable prices and moderate long-term interest rates.

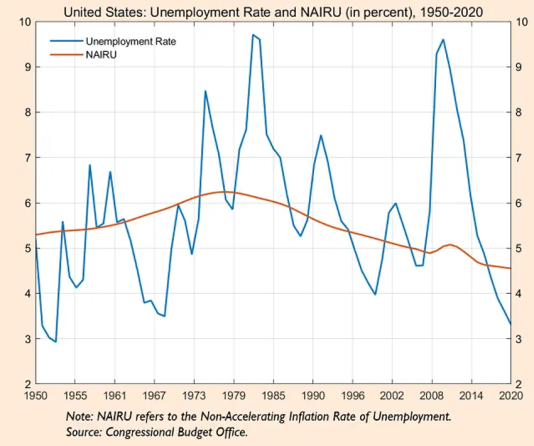

In Tuesday’s testimonial, Chairman Powell was asked if the Fed can achieve their mandate of full employment. In other words, “anyone who wants to work and can work will have a job available to them”. While it is nearly impossible to reach 100% employment (as it is within the organic behaviors for workers to quit and transfer between occupations), maximum employment represents a level that should reflect normal economic conditions. Powell reiterated that “it is their goal and it is what they are working to do at all times.” While he further explained that they are “never” going to fully achieve their goal, he confirmed that they have made a lot of substantial progress. The unemployment rate is at the lowest level in 49 years. Participation in the prime working labor force, ages 25-54, is at its highest level in more than a decade.

On the other hand, there was not much additional news on the Fed’s inflation target over the last couple days. Core inflation still stands around 1.6%, which is well below the Fed’s 2% target. However, the Fed maintains optimism that this figure will move closer to 2% over the coming months.

Why do we care? Essentially, short-term interest rates are set with an eye to managing pricing pressure and inflation, as the Fed wants to maintain both purchasing power and stable monetary policy. As inflation rises, the Fed uses interest rates in an attempt to prevent extreme inflationary or deflationary pressures in the economy.

It is important to refer to last year’s Fed cuts on interest rates during the period of low unemployment rate and emerging wage pressures (i.e., they were precautionary instead of reactionary). The Fed’s most recent comments around inflation help provide the rationale for these previous cuts and reiterate that they do not expect the need for a hike anytime soon. Ultimately, the need to get back to the 2% target is imperative, as it will allow the Fed to use their full toolkit if needed to reduce rates further in the case of a future economic downturn.

2) Given this information, where does the Fed Stand?

Ultimately, Powell’s field trip to congress was quite uneventful and reconfirmed the goals that were shared at the Fed meeting earlier this month. The Fed reiterates that we are now in the eleventh year of an economic expansion, the longest on record, and feels the “mid-cycle adjustment” last year was enough to combat global headwinds and stabilize economic activity. While the market is expecting the Fed to cut rates 1-2 more times over the next 12 months, the Fed is seeing the same things that we’re seeing: healthy consumer balance sheets, rising consumer confidence, and a stabilization in the global growth backdrop.

3) What is my view?

When entering the beginning of the year, the Fed was operating under the basis that they would keep interest rates on hold throughout the year, with risks that skewed more towards cuts than hikes. Following the Fed meeting earlier this month and Powell’s two days in Capitol Hill, the guidance still makes sense.

However, with the coronavirus outbreak, Powell acknowledged that the risk of a rate cut has risen due to its potentially negative impact. Ultimately, the Fed has done enough to ease financial conditions, giving them the comfort to remain on hold. Of course, if the coronavirus outbreak escalates or inflation expectations come in lower than expected, the Fed could potentially change course. The bottom line is that while there are evolving risks surrounding this view, the U.S economy is in a reasonably solid place with steady growth and inflation ticking up slightly at the margins.

Works Cited:

Image Source: https://www.advisorperspectives.com/dshort/updates/2020/03/06/the-civilian-labor-force-unemployment-claims-and-the-business-cycle

Image Source: https://www.ft.com/content/cf3fc066-141f-11ea-9ee4-11f260415385

Image Source: https://matttopley.com/topleys-top-ten-january-7-2020/

Cox, J. (2020, February 11). What to look for from Fed Chair Powell’s testimony. Retrieved from https://www.cnbc.com/2020/02/10/what-to-look-for-when-fed-chair-powell-meets-with-congress-this-week.html

Davies, G. (2019, December 6). The consequences of ultra-low US unemployment. Retrieved from https://www.ft.com/content/cf3fc066-141f-11ea-9ee4-11f260415385

Rugaber, C. (2020, February 12). A Trump Fed choice faces Senate scrutiny over policy views. Retrieved from https://www.news4jax.com/business/2020/02/13/a-trump-fed-choice-faces-senate-scrutiny-over-policy-views/

Smialek, J. (2020, February 11). Powell, Warning of a Possible Virus Fallout, Is Slammed Again by Trump. Retrieved from https://www.nytimes.com/2020/02/11/business/economy/jerome-powell-federal-reserve-coronavirus.html

Timiraos, N. (2020, February 10). Fed Chairman Heads to Capitol Hill Facing New Questions Over Growth Risks. Retrieved from https://www.wsj.com/articles/fed-chairman-heads-to-capitol-hill-facing-new-questions-over-growth-risks-11581346800

Leave a comment