By: David Behrens

Economic theory indicates that the modern US patent system is counterproductive. How can we change this?

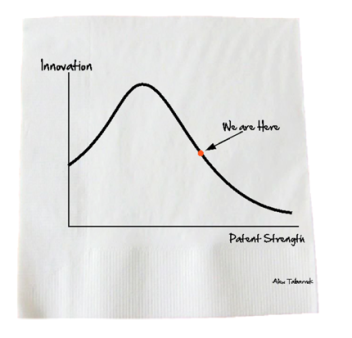

Consider the following sketch:

This is the Tabarrok Curve. Its appearance on a napkin is an homage to the Laffer Curve, Arthur Laffer’s massively influential idea that increasing tax rates could reduce tax revenues, which Laffer first illustrated on a bar napkin. Alex Tabarrok, a George Mason professor and co-author of the famous blog MarginalRevolution.com, chose the same medium to casually introduce his ideas on patent laws in America. The insight conveyed in this curve is that the US patent system in its current form discourages innovation by making it costlier, rendering patent laws largely counterintuitive.

Where do Patents Go Wrong?

Patent laws are put in place to create incentives to innovate, or rather to remove disincentives which may cause innovators to hesitate. The Austrian economist Joseph Schumpeter, famous for comprehensively introducing the concept of creative destruction, was one of the first to note that innovation is partially motivated by the potential to hold monopoly power; that is, if a firm discovers something new, they can temporarily enjoy substantial profits from selling it exclusively while other firms catch up. Patent laws are intended to augment this incentive by ensuring that firms cannot simply copy a product that has been patented. This provides a cushion which makes firms more comfortable with the idea of introducing new products.

Unfortunately, many firms operating within the current patent system are too comfortable. Patents create barriers to entry for firms (especially small ones) which may otherwise grow and generate more innovation. Moreover, patents intended to delay firms from entering new markets may stop them altogether, preventing them from building on the progress of similar producers who hold patents, and thus impeding innovation. For instance, when the iPhone and other smartphones were first introduced a decade ago, the market quickly became saturated in legal red tape, in what were known by some as the “smartphone patent wars.” This led to the smartphone market being dominated largely by well-established tech companies, which may or may not have been avoidable.

Meanwhile, firms enjoying monopoly power are able to keep prices above the equilibrium brought about by more competitive markets, so consumers lose out. The current laws also empower “patent trolls,” which are firms or their representatives who threaten legal action against potential competitors, even when they have a weak or dubious case. Patent trolls are notoriously persistent, and unfortunately, the modern legal structure of patents is both strong and complex enough to allow these trolls to intimidate small firms and prevent them from releasing their own inventions.

Tabarrok argues that at some point, it is more costly to produce copies of existing products than to create new ones. After all, only innovation has the potential to bring about coveted monopoly profits. It’s therefore likely that the patent system addresses problems that aren’t as severe as one would expect. In addition, it fails to provide a solution to patent disputes in which two firms make a new discovery at the same time, even though these disputes are among the most common.

In various works, Tabarrok has advocated for U.S. patent laws in most sectors to be significantly weakened, which he believes will have a net benefit on economic growth. However, he is not dogmatically committed to such reductions; in fact, he believes that patents in the U.S. pharmaceuticals industry should be strengthened, due to the unique nature of that industry. To be specific, FDA testing requirements and other regulations make innovation in pharma extremely expensive; in fact, a recent study estimates that the average costs of producing a single approved new compound add up to about 3 billion dollars. On the other hand, imitating publicly available drugs is cheap and easy. In this case, without strong patents, the period of monopoly profit experienced by an innovative firm could never last long enough to compensate for the high costs of testing and discarded compounds, so pharmaceutical firms wouldn’t even bother attempting to innovate.

This scenario makes one wonder if there are other cases in which patent laws act as a necessary evil. Such cases would most likely involve goods markets which, like pharma, carry high costs of innovation and relatively easy imitation of existing products. One of the first sectors that comes to mind is the automobile industry, which, like pharmaceuticals, is highly regulated, leading to high innovation costs. However, it is different in many crucial ways, the most important being that the automotive industry is much more production-based than pharmaceuticals, and less reliant on consistent innovation. In addition, many new innovations in the automotive industry are relatively small, and it’s very unlikely for a manufacturer to come up with anything game-changing enough to garner monopoly power in the Schumpeterian sense (though companies like Tesla are beginning to expose a growing potential for unique innovations). Also, automobile producers never imitate their competitors’ products completely; for example, Ford will never produce a Chevy Silverado.

Based on these and other factors, it seems that innovation in the automotive industry is lucrative enough not to merit stronger patents, as evidenced by the willingness of firms to introduce innovations like heated seats, hybrid technology, interactive navigation systems and more, which have all quickly become ubiquitous. It’s much more likely that this industry is, like most others, beyond the Tabarrok Curve’s maximum. However, it is probably not as far along the curve as some other sectors such as personal electronics. This leaves one wondering if there is an effective way of evaluating each sector’s position on the curve, and how doing so could allow for the pursuit of more effective patent laws.

Tabarrok in His Own Words: What Should be Done?

I contacted Alex Tabarrok asking for insight on this issue. He was gracious enough to respond within a day with the following comments:

Yes, I agree with you that where we are on the ‘Tabarrok Curve’ will vary by industry. The diagram is a judgment call but meant more to get people thinking than anything else. … [Patent] theory says we need patents when innovation costs are high relative to imitation costs. Yet, patent law ignores this entirely. Everyone with a novel, non-obvious idea gets a 20 year patent, for example, regardless of whether their innovation costs were a billion dollars or $20. Ideally, we would have different patent terms by R&D costs. We do have R&D tax credits so this doesn’t seem impossible but a simpler system would go by industry, say shorter terms for software patents than for pharmaceuticals. An even simpler system would offer say three classes of patents 2, 10, and 20. The nice thing about this system is that we could encourage people to self-identify by saying if you ask for a 2 year patent we are in all likelihood going to approve it quickly but if you ask for a 20 we are going to ask for more information about R&D costs. In this way, the system would require less top-down planning.

I encourage you to look further into Tabarrok’s writing (see References) for more information regarding the current patent system and its disregard for patent theory. Essentially, the takeaway from his work is that patents are too strong to be useful in most industries, and that there are many politically viable ways of reforming the patent law system, preferably so that it is based on R&D costs. In a developed country like the US, innovation is the most important source of long-run economic growth, making such reforms crucial.

References

DiMasi, J. A., Grabowski, H. G., & Hansen, R. W. (2016, May). Innovation in the pharmaceutical industry: New estimates of R&D costs. Retrieved from https://www.ncbi.nlm.nih.gov/pubmed/26928437

Optimist, R. (2015, September 23). The Tabarrok curve. Retrieved from http://www.rationaloptimist.com/blog/the-tabarrok-curve/

Segal, D. (2013, July 13). Has Patent, Will Sue: An Alert to Corporate America. Retrieved from http://www.nytimes.com/2013/07/14/business/has-patent-will-sue-an-alert-to-corporate-america.html

Tabarrok, A. (2002, 01). Patent Theory versus Patent Law. Contributions in Economic Analysis & Policy, 1(1). doi:10.2202/1538-0645.1039

Worstall, T. (2013, June 24). The Tabarrok Curve: Why The Patent System Is Not Fit For Purpose. Retrieved from https://www.forbes.com/sites/timworstall/2013/06/23/the-tabarrok-curve-why-the-patent-system-is-not-fit-for-purpose/#6b280a335d25

I. (2015, June 29). Sequenom case leaves pharma confused over patent law. Retrieved from https://www.in-pharmatechnologist.com/Article/2015/06/30/Sequenom-case-leaves-pharma-confused-over-patent-law

Leave a comment