Category: Aaron Puthan

-

Special Purpose Acquisition Companies, or SPACs, have seen a meteoric rise in popularity…

-

Around a month ago, I talked about the implications of Asian under a re-elected President Trump. Now that Biden has become elected the 46th president of the United State, I will focus on a Biden presidency scenario…

-

Chinese economic output is expected to reach pre-COVID levels this quarter, well ahead of other major global economies. The recovery so far has been led by production and trade, but domestic consumption is starting to catch up. This supports my constructive view of Chinese assets

-

As we’ve witnessed over the last four years, the White House holds considerable sway over foreign economic and trade policies, making this election particularly consequential for markets in Asia. Three areas that will likely be impacted the most are trade, supply chains, and tech.

-

Five Firms removed from UN PRI, what a Task Force on Nature-related Financial Disclosures will achieve…

-

I bet Chairman Powell didn’t expect to announce changes to the Fed’s statement of its long-run goals over a video conference from his home office when he was first appointed, but times are strange.

-

China’s recovery from COVID-19 crisis remains uneven, with state investment and production leading a relatively weak consumer recovery. Two important trends are emerging that provide insight into both the near term growth trajectory, and how the investment landscape might shape up.

-

What is the Fed’s toolkit in the case of a future economic downturn?

-

By Aaron Putham Crude oil demand destruction caused by COVID-19 is expected to be the largest on record, which has created concern about where to store all the unused oil At this stage the only cure for low oil prices will be low oil prices Over the next 12-18 months, the opportunity to play a…

-

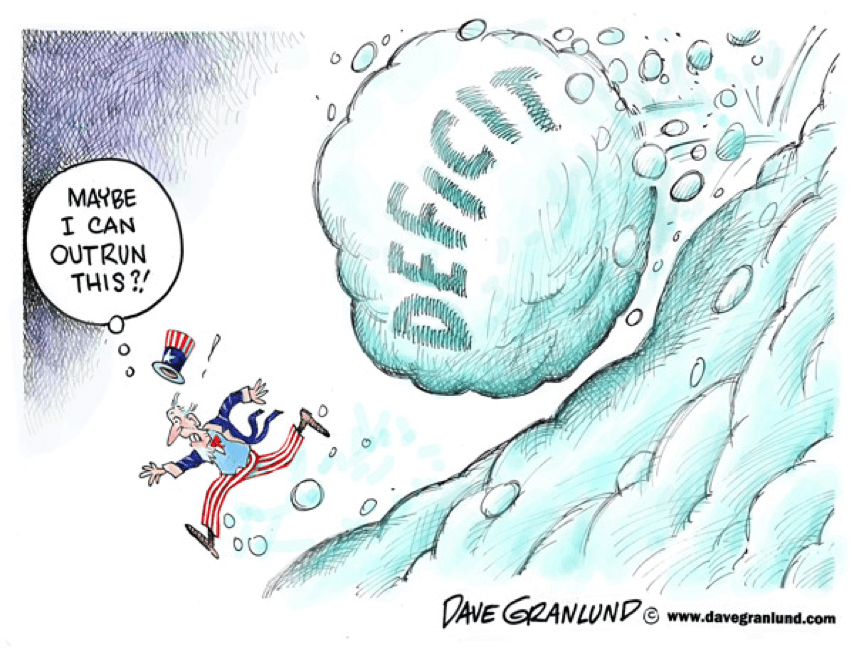

The budget deficit of the United States has ballooned to new levels, so what are its implications?

-

WeWork slashes its IPO as skepticism rises over its risky business model