The U.S. has altered trade history when President Trump has raised tariffs on nearly all of its trading partners. Now, as the most powerful nations of the world are turning away, how should civilian life react, and who will be left most vulnerable to retaliation?

By: Sofiia Krazhan

Edited by: Eric Chen

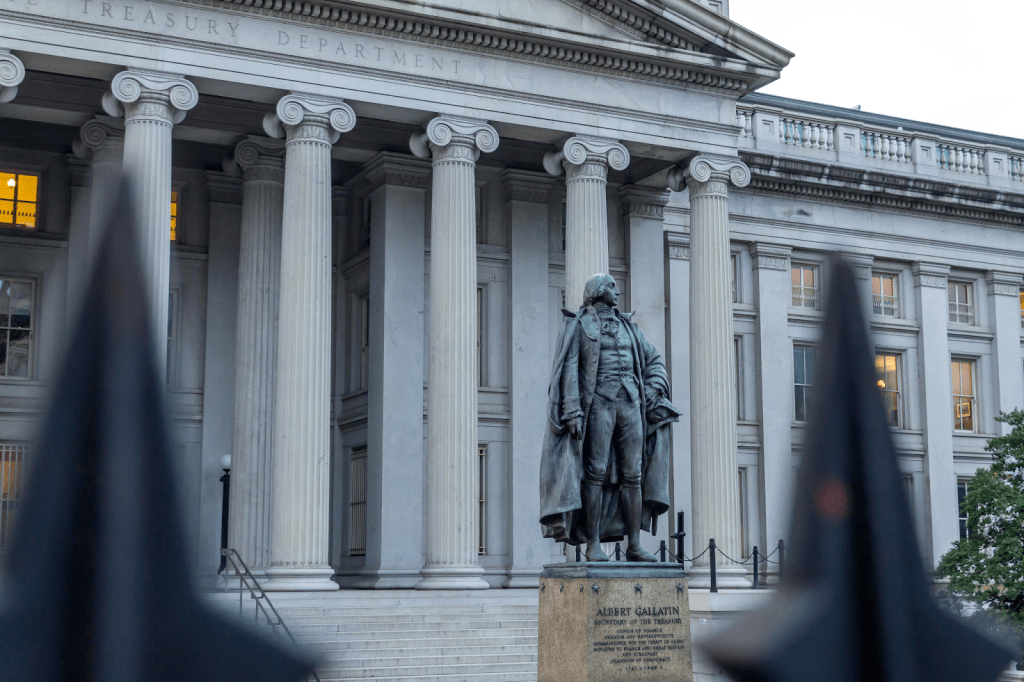

The world was to end on April 2nd, and everyone’s homes were to be swept away from their hands. Bank accounts were to be emptied, and 2008’s fall of Lehman was underway once more. But due to the “yippy” response of the markets, President Trump “unpredictably” backed down from the majority of Liberation Day tariffs. Taking into account the Trump administration’s performance from 2016 to 2020 economically, it is only expected that starting another trade war with China would end just as it did last time with the suspension of tariffs due to the symbiotic relationship between the United States and Chinese economies. According to the Council on Foreign Relations, “The value of U.S. goods imports from China rose from about $100 billion in 2001 to more than $400 billion in 2023. This leap in imports is due in part to China’s critical position in global supply chains; Chinese factories assemble products for export to the U.S. using components from all over the world.” (https://www.cfr.org/backgrounder/contentious-us-china-trade-relationship) And such symbiosis is far from easily ended with a blanket ad valorem slapped on top of goods, as promised on election day.

Now, almost 140 days later, on April 9, the Trump administration paused tariff implementation on almost all its trading partners for 90 days as pressures mounted from Trump administration officials, international leadership, and the Federal Reserve. According to the New York Times, “In an abrupt reversal, President Trump said he would back down on his reciprocal tariffs for the next 90 days, bringing tariff levels to a universal 10 percent, [… raising] tariffs on its exports to 125 percent after Beijing announced a new round of retaliation.”

It is without surprise that the U.S. now finds itself in a situation where uncertainty has mounted in the minds of Americans everywhere, from investors to public servants to the general public. The fear of international retaliation against such tariffs has finally reached the Oval Office. The very real threat emerging from East Asia is that three of the most powerful states and economies (Japan, China, and South Korea) have united on tariffs and trade policy.

President Trump’s tariff implementation could start an effort of trade renegotiation, and perhaps there is some measure of protectionism that is meant for the good of Americans. However, for those who do not spend all their time on Robinhood, Public.com, or Bloomberg Terminal deciding what next investment will let them stay ahead of the curve, here is some practical advice on what tariffs mean for an average individual.

The first concern, without a doubt, is inflation; however, it will unfold at different times depending on how and when policies are implemented. If tariffs are imposed long-term, they will raise the cost of importing goods that the U.S. cannot produce domestically, such as bananas, coffee, and certain varieties of apples. Since these goods have no local substitutes, the higher import costs will be passed on to consumers, driving up prices. This inflation is driven not by increased demand, but by restricted or more expensive supply.

This is because, while goods might be easier to find, grow, and transport within the U.S., the country’s farming sector isn’t as efficient as those in other nations where agriculture is the primary economic activity. In other words, the U.S. has a higher opportunity cost when it comes to farming — meaning the resources (land, labor, etc.) could be used more productively in other industries, like technology or manufacturing.

Now, if a country’s economy were entirely based on agriculture, imposing tariffs on agricultural imports might make sense — at least in the short term. The idea is that if imports were restricted, the domestic agricultural sector would grow to meet demand. However, in reality, this would cause significant disruption. The shift would be so drastic that many people employed in other sectors of the economy (like tech or manufacturing) might lose their jobs, and those in agriculture might not be able to fill the demand fast enough.

So, the reason it could make sense to implement the tariff would be to protect jobs and industries directly tied to agriculture. But, in a country that relies on diverse industries for productivity, the economic disruption could outweigh any potential benefits, making such a policy risky.

The U.S. Department of Agriculture (USDA) reports that “U.S. agricultural exports are projected at $170.5 billion, while imports are forecasted to reach $219.5 billion.” The 2018 retaliatory tariffs had significant impacts on “U.S. agricultural exports, affecting products valued at $30.4 billion in 2017.” In the case of agricultural tariffs, my recommendation is to stock up on produce and make as much banana bread as you can, because there is a chance that bananas will go the newly unaffordable way of eggs, and coffee will go the old-timey unaffordable way of luxury purses.

For first-time motor vehicle owners, particularly car buyers, the manufacturing sector in the U.S. has seen a steady decline since the 1980s, dropping from 35% of GDP to just 8%. According to the Anderson Economic Group (AEG), “tariffs could add between $2,500 and $5,000 to the cost of the lowest-tariffed American cars and up to $20,000 for some imported models.” The total impact on U.S. consumers is projected to be around $30 billion in the first year alone. While some argue that American industry has been harmed by trade agreements like NAFTA and free trade, a tariff might not be the solution. While tariffs might seem like a way to protect U.S. manufacturing, the reality is that most Americans might not be willing to accept significantly higher car prices just to bring back manufacturing jobs. What could appear as a straightforward method to safeguard American industry could, in fact, end up being a Trojan horse for inflation, ultimately raising costs for consumers without fully addressing the underlying issues in manufacturing.

Some experts have estimated that the price of a new car with tariffs would rise by as much as $12,000; thus, the switch from Mitsubishi to Lincoln would not make a difference for the average American. Beyond imported cars from Japan, the manufacturing sector in the U.S. receives raw materials from countries like Mexico, Canada, and China, the primary targets of the Trump administration’s tariffs. The Center for Automotive Research (CAR) highlights that the “complexity of the global automotive supply chain… complicates the impact of a uniform 25% tariff on all trading partners. They estimate an increased cost of $107.7 billion to all U.S. automakers and $41.9 billion specifically to the Detroit Three (D3) automakers.” This means that even though a Lincoln might be a more patriotic option, the price difference between a Lincoln and a Mitsubishi is going to be marginal but significantly pricier. So once again, when facing uncertainty as severe as the impact of tariffs and looking to purchase a new vehicle, now is the best time.

Unless they are cars from Tesla. Elon Musk’s presence in the government has been the subject of many criticisms from conservatives and liberals alike, and Tesla’s cars, while already losing money with each newly manufactured vehicle, did not help Mr. Musk when the stock price dropped in half. Tesla is cheap and significant, and the resale markets have been very liberal with Tesla prices. Regarding Tesla, recent data shows that “in 2024, Tesla produced 1,773,443 vehicles and delivered 1,789,226 vehicles globally. This marked a slight decline in sales of 1.1% compared to 2023, which was the first annual decline in 12 years.” Despite challenges, “Tesla held a 48.2% market share in the U.S. electric vehicle (EV) market, maintaining its position as the dominant player.” While the company faces challenges, Tesla’s affordability and strong resale market have made it a popular choice. In the context of tariffs, however, it’s worth considering how U.S. car manufacturers, particularly traditional ones, could struggle to compete with Tesla’s continued dominance in the electric vehicle sector. Tariffs could raise the prices of foreign and domestic cars alike, but with Tesla’s relatively lower costs and innovation in EVs, it could remain one of the few vehicles that stay competitive for the average consumer — even as traditional auto prices rise, even with countless safety concerns over Cybertrucks and spontaneous combustion, it would be best to steer clear of Tesla unless you desire to live life on the wild side.

Finally, international travel is going to get significantly pricier for Americans. As tariffs on imported goods rise, the cost of international travel is likely to increase as well, particularly in the form of higher taxes and fees on plane tickets. Tariffs don’t just affect the price of products that consumers buy; they also drive up the operational costs for airlines, hotels, and other travel-related businesses. When the costs of doing business rise, companies tend to pass those increased expenses onto travelers. For example, the U.S. is currently facing tariffs that could affect not just imports, but also the pricing structure for international travel. Airlines may be forced to raise ticket prices to offset higher costs tied to international tariffs, especially when flying to countries that are directly impacted by U.S. tariffs or that impose retaliatory measures. The global economic fallout from these tariffs is already creating noticeable shifts in travel patterns. Polls say that 69% of Canadians are less likely to visit the U.S. in 2025 compared to 2024, and 36% of Canadians with U.S. travel plans have already canceled them. The reason? Tension over economic tariffs, trade restrictions, and diplomatic disputes. According to the U.S. Travel Association, “a 10% reduction in Canadian travel could result in two million fewer visits, $2.1 billion in lost spending, and 14,000 job losses.” Americans could face similar consequences when traveling abroad. If countries that are major trade partners with the U.S. retaliate with their own tariffs or higher taxes on U.S. goods, it’s possible that they will impose higher entry fees on U.S. travelers as well. American travelers could see higher visa fees, tourism taxes, or even increased flight prices as a result of these trade tensions. For example, Europe, China, or Mexico—key trading partners that could respond to U.S. tariffs with protectionist measures—may increase fees for Americans visiting, further inflating the cost of international travel.

Buy now, pay later, but do not finance your meals.

Leave a comment