By Jola Sonowo

Edited By Zane Govindraj

How much longer can you handle someone telling you to buy Bitcoin because this is the cheapest it will ever be? Given the election results, you’ll likely hear this phrase much more often—and they may be right. Whether you are a cryptocurrency enthusiast or know nothing about it, the technology underpinning cryptocurrencies, blockchain, is poised to become a foundational element of our increasingly technological society.

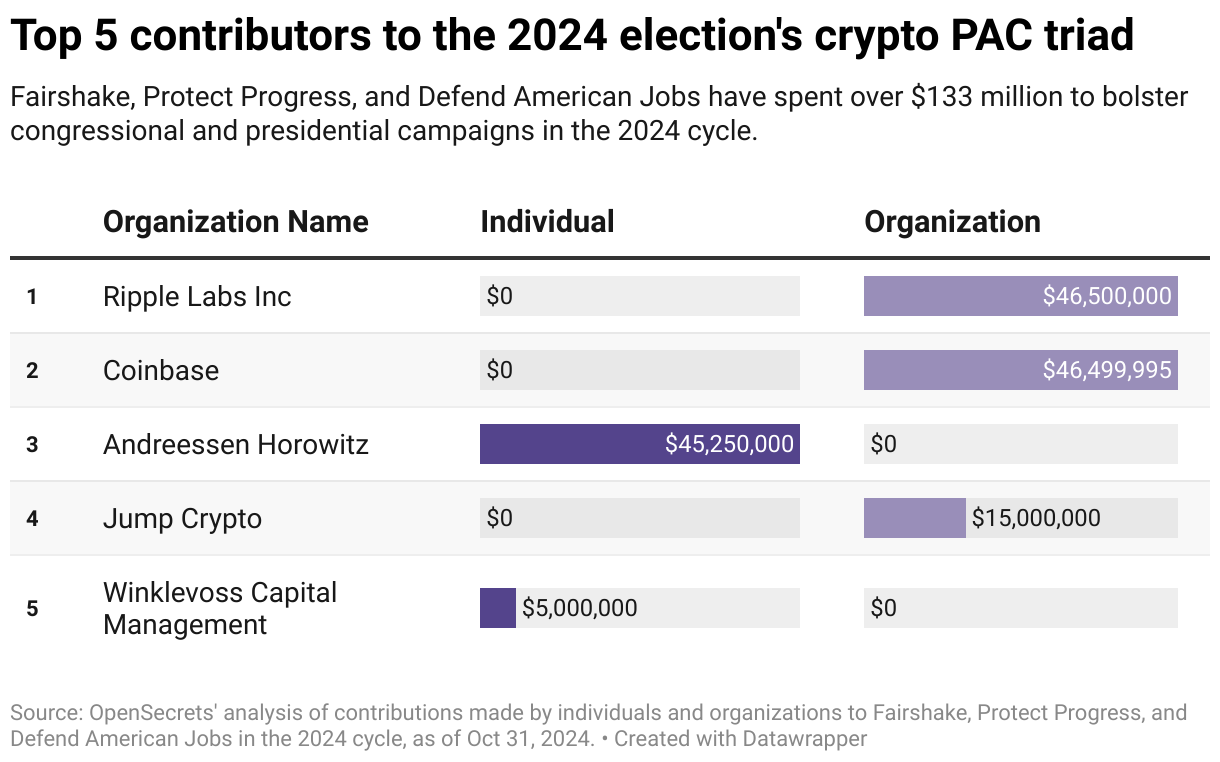

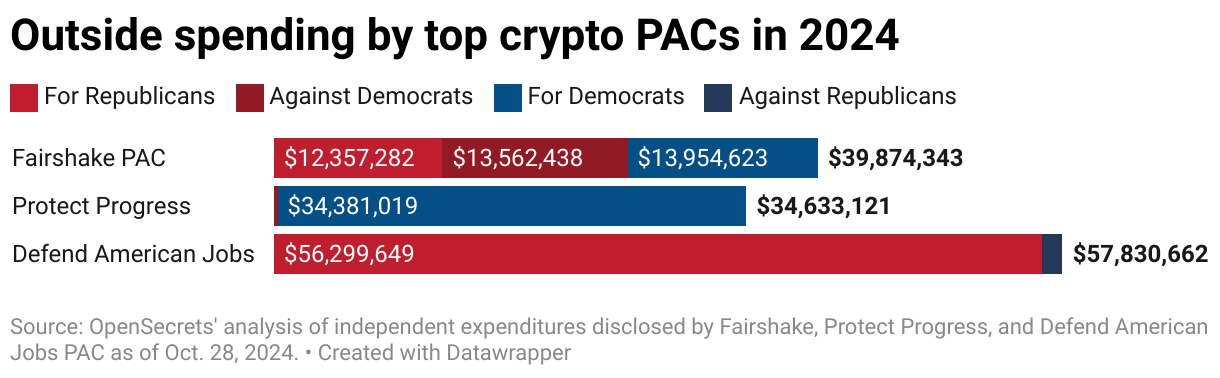

For many voters, cryptocurrency was not a major policy issue during the 2024 election. Nevertheless, a trio of pro-cryptocurrency super political action committees—Fairshake, Protect Progress and Defend American Jobs—invested more than $133 million into the election, according to OpenSecrets. With cryptocurrencies becoming more mainstream, U.S. lawmakers have faced increasing pressure to establish a clear and comprehensive regulatory framework for this rapidly evolving industry.

This influence extended to both federal and state levels leading up to Election Day. In December 2023, three super PACs backed by prominent crypto figures announced plans to invest $78 million to support candidates favorable to the industry. Fairshake alone raised over $200 million through major donations from stakeholders such as the Winklevoss twins, Kraken, Coinbase and Electric Capital Partners. The group reportedly spent $10 million on attack ads targeting Representative Katie Porter in California’s Senate race, which she ultimately lost. Similarly, the Cedar Innovation Foundation, another super PAC with undisclosed backers, worked to unseat Senate Banking Chairman Sherrod Brown in early 2024.

Before President Joe Biden withdrew as the Democratic candidate, Republican candidates were the primary beneficiaries of super PAC support. However, the dynamic shifted quickly when Vice President Kamala Harris entered the race. A new advocacy group, Crypto4Harris, featuring high-profile backers like billionaire Mark Cuban and SkyBridge Capital founder Anthony Scaramucci, supported Harris, viewing her as more receptive to the industry’s concerns.

During the Democratic National Convention on August 21, an aide to Harris’ team stated she would support policies to expand the industry. Harris later reiterated this position at a Wall Street fundraiser, emphasizing that consumer protection was a cornerstone of her Opportunity Economy pledge—which involves safeguarding individuals from exploitation and ensuring equitable participation in the economy through measures like capping prescription drug prices, reducing housing costs and banning corporate price gouging on essentials.

At a rally in Erie, PA., she announced plans to establish rules for digital assets. Following this, Chris Larsen, co-founder of Ripple Labs, donated one million dollars worth of XRP tokens to Future Forward, a significant super PAC backing Harris. Ripple Labs, which has been embroiled in a legal battle with the U.S. Securities and Exchange Commission over XRP sales, received favorable rulings in August, though the Securities and Exchange Commission reopened the case in October according to Investing News.

The regulatory landscape for cryptocurrency in the United States remains in flux. Various government agencies have employed diverse strategies to regulate different aspects of the industry, reflecting their mandates.

The SEC, led by Chairman Gary Gensler under President Biden’s administration, has maintained that many cryptocurrencies qualify as securities and are thus subject to federal securities law. Conversely, the Commodity Futures Trading Commission views cryptocurrencies, such as BTC and ETH, as commodities due to their lack of backing from a government or central authority according to Investing News.

According to The New York Times, the cryptocurrency industry spent more than $130 million on the 2024 election, resulting in significant victories for pro-cryptocurrency congressional candidates. This shift is expected to pave the way for legislation that could limit the Securities and Exchange Commission’s authority over the industry. Even lawmakers not up for election may now hesitate to oppose cryptocurrency interests after witnessing its fundraising power.

President-elect Donald Trump, once a vocal cryptocurrency skeptic, has pledged to end the Biden administration’s regulatory crackdown and transform the United States into “the crypto capital of the planet.” Trump’s appearance at a Bitcoin conference in Nashville and his subsequent launch of a cryptocurrency business further signal a dramatic policy shift.

Although none of the super PACs contributed to presidential campaigns, their spending elevated cryptocurrency from a niche issue to a major campaign topic. Fairshake has already announced plans to raise $78 million for the 2026 midterms, signaling that the industry’s influence in American politics is only beginning.

The 2024 elections have underscored the growing influence of the cryptocurrency industry in shaping public policy. With an increasingly pro-cryptocurrency Congress and a receptive executive branch, the regulatory landscape is poised for significant changes. As the industry continues to expand its political footprint, voters and policymakers alike will need to grapple with the implications of integrating blockchain and digital assets into the broader economy.

Leave a comment