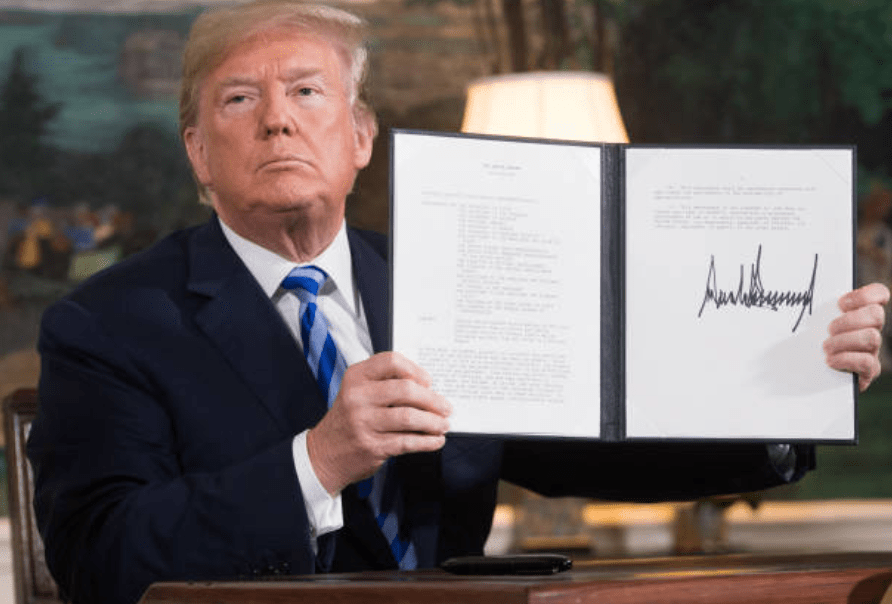

US-IRAN-NUCLEAR-DIPLOMACY – US President Donald Trump signs a document reinstating sanctions against Iran after announcing the US withdrawal from the Iran Nuclear deal, in the Diplomatic Reception Room at the White House in Washington, DC, on May 8, 2018.

By Arya Nadella

Edited By Paola Martin

Few nations embody the economic impact of international policies like Iran. For decades, sanctions imposed by the United States, the UK and the UN have left the country isolated from much of the world. These sanctions, driven by fears over Iran’s nuclear ambitions, have constrained its ability to trade, invest and grow, making its economy one of the most studied examples of how international decisions shape national outcomes.

At the center of these policies lies U.S. leadership. Barack Obama, the 44th President of the United States, pursued diplomatic breakthroughs that reshaped Iran’s economy. In contrast, Donald Trump, the 45th and now 47th president, adopted a “maximum pressure” strategy that impacted the country’s economic trajectory. With Trump’s reelection in 2024, this saga has entered a new chapter – one that continues to test the limits of Iran’s resilience and the power of U.S. foreign policy.

Sanctions against Iran date back decades but became especially stringent in the early 2000s, with a specific focus on the country’s nuclear program. According to the International Atomic Energy Agency (IAEA), Western powers expressed concerns that Iran’s nuclear activities could lead to the development of weapons, despite Tehran’s claims that the program was intended for peaceful purposes like energy production. Consequently, such fears drove the implementation of these increasingly restrictive measures.

These sanctions have done more than restrict Iran’s nuclear activities; they have crippled its economy. For an oil-rich nation, the inability to freely sell its oil has been catastrophic. Iran’s GDP, largely driven by oil exports, shrank significantly during periods of heightened sanctions. According to the International Energy Agency, oil exports plummeted from 2.5 million barrels per day in 2012 to less than 500,000 barrels in 2019 – a decline of 80%. This export collapse deprived the government of critical revenue, forcing cuts to social programs and public services.

Sanctions also cut Iran off from the global financial system, with its banks unable to transact with international institutions. The result? Widespread inflation, the devaluation of the rial (Iran’s currency) and reduced access to essential goods, from medicine to industrial parts. According to the World Bank, inflation soared to over 40% by late 2023, leaving ordinary Iranians struggling to afford basic necessities.

In 2015, President Barack Obama and other world leaders brokered the Joint Comprehensive Plan of Action, commonly known as the Iran Deal. This landmark agreement aimed to curb Iran’s nuclear capabilities in exchange for lifting sanctions. Under the deal, Iran agreed to reduce its stockpile of enriched uranium by 98%, shut down advanced centrifuges critical for weapons-grade enrichment and allow international inspections to ensure compliance.

The economic effects were immediate. With sanctions lifted in 2016, Iran’s oil exports surged, doubling within months. That year, the country’s GDP grew by an extraordinary 12.5%, according to the World Bank. Trade deals followed swiftly, including a $17.6 billion agreement with Boeing for passenger planes. Iran began reintegrating into the global economy, and optimism for sustained growth soared.

The optimism, however, was short-lived. In 2018, President Donald Trump withdrew the U.S. from the JCPOA, calling it “one of the worst and most one-sided transactions the United States has ever entered into.” Sanctions were reimposed with unprecedented intensity, targeting not only Iran’s oil exports but also its banking, automotive and shipbuilding sectors.

As a result, the economic fallout was immediate and severe. According to the World Bank, Iran’s oil production had plummeted by 80%, and inflation soared to 30% by 2019. The already volatile rial lost much of its value, plunging millions of Iranians into economic hardship. International companies that had re-entered the Iranian market, such as Total and Peugeot, quickly withdrew, further isolating the economy.

With Donald Trump’s return to the White House in 2024, Iran faces an uncertain future. Early indications suggest a continuation of the hardline approach that defined his first term. Experts predict that sanctions will not only remain but may tighten further, targeting even informal trade networks that Iran has relied on to bypass restrictions. Such measures could have consequences that extend well beyond Iran. For instance, neighboring countries like Iraq and Afghanistan, which maintain strong economic ties with Iran, are likely to experience trade disruptions. European nations seeking to salvage the nuclear deal could also find themselves further alienated from U.S. policies, which may strain transatlantic relations and complicate diplomatic efforts. Additionally, these challenges may ripple through global supply chains reliant on goods flowing through the region, exacerbating economic uncertainty worldwide.

For Iran, the implications are grim. Oil exports, already a fraction of their pre-sanctions levels, are expected to dwindle even further. Inflation, which hovered at 40% in late 2023, is projected to rise as sanctions strain supply chains. Iranian policymakers often describe these measures as “economic warfare.” Specifically, in 2018, Iran’s Foreign Minister Mohammad Javad Zarif referred to sanctions as “economic terrorism,” while in 2019, then-President Hassan Rouhani described the U.S. maximum pressure campaign as “a terrorist act against Iran’s economy.” These statements reflect a widely held view among Iranian leadership that sanctions are not merely diplomatic tools but aggressive measures intended to destabilize the nation’s economy and society.

Ordinary Iranians, already struggling to afford basic necessities, may face even greater challenges. Critics note that these hardships are not solely the result of external pressures. Iran’s over-reliance on oil exports and lack of economic diversification have left the country particularly vulnerable to sanctions. Insufficient development in sectors such as manufacturing and technology has limited Iran’s ability to buffer against external shocks. These internal weaknesses, combined with stringent sanctions, create a cascade of economic instability that amplifies the challenges faced by the population.

On the global stage, renewed sanctions on Iran could exacerbate volatility in energy markets, driving up oil prices and straining economies dependent on energy imports. As reported in The Wall Street Journal, the reimposition of sanctions could increase global energy prices by up to 15% due to disruptions in Iranian supply. Beyond energy markets, these sanctions deepen geopolitical rifts, particularly between the U.S. and its European allies, who have sought to maintain trade ties with Iran under the nuclear deal. This tension has strained transatlantic relations, with European countries attempting to create financial mechanisms to bypass U.S. sanctions. Additionally, countries heavily reliant on Iranian oil, such as India and China, face increased costs and supply chain challenges, further complicating global trade dynamics.

The U.S.-Iran relationship illustrates how leadership changes in major powers can reshape global economics. Under Obama, diplomacy opened a path for economic recovery; under Trump, maximum pressure reimposed severe constraints. With Trump’s return, Iran’s economy is once again at the mercy of U.S. policies.

This pattern extends well beyond Iran. U.S.-China relations, for instance, have undergone dramatic shifts with changes in U.S. leadership, significantly influencing global trade flows and supply chains. The trade wars launched during the Trump administration disrupted markets worldwide, showcasing how leadership transitions can reshape international economic dynamics. Similarly, U.S.-Mexico relations highlight the impact of shifting goals, from the renegotiation of NAFTA into the USMCA to evolving border policies. The updated trade agreement under Trump introduced new labor and environmental standards, altering supply chains and redefining economic ties between the two nations. These instances highlight how each administration’s priorities reshape relationships with key neighbors.

The U.S.-Iran dynamic mirrors a broader trend in global politics, where leadership changes in major powers have far-reaching consequences on alliances, trade systems and regional stability. For nations like Iran, whose economic survival often depends on decisions made in Washington, this interconnectedness underscores how global stability often hinges on the priorities of a few key nations.

In conclusion, Iran’s economy tells a story of resilience amid relentless external pressures. Yet it also highlights the profound impact of U.S. leadership on global economic realities. Whether through diplomacy or sanctions, decisions made in Washington ripple across the world, reshaping lives and livelihoods far beyond its borders. As Trump’s second term unfolds, Iran’s future remains uncertain. The interplay between politics and economics continues to define this saga, offering a sobering reminder of the power major nations wield over the economic futures of others.

Leave a reply to 1088sdf544 Cancel reply