Private equity, long thought of as synonymous with corporate greed, may actually be a positive force in society.

Written by Amal Garekar

Edited by Rushil Yelma

The private equity industry has long been negatively viewed by a significant proportion of American voters. New York Times columnist Farhad Manjoo blames private equity for the “accelerating, behind-the-scenes desiccation of the American economy.” The roots of such perception can be traced to the 2008 subprime mortgage lending crisis, which generated much vitriol towards the financial services sector in general. The notion that private equity firms have minimal value addition, increase unemployment, and extract all the benefits for themselves seems to have become more prevalent since then. Manjoo cites “Pirate Equity,” a 2019 study that alleges that private equity firms were directly involved in several of the largest retail bankruptcies in the past decade. The study also claims that these bankruptcies, along with the purported practices of private equity firms to “cut jobs and lay off employees” upon acquisition of a company, resulted in the elimination of nearly 600,000 jobs.

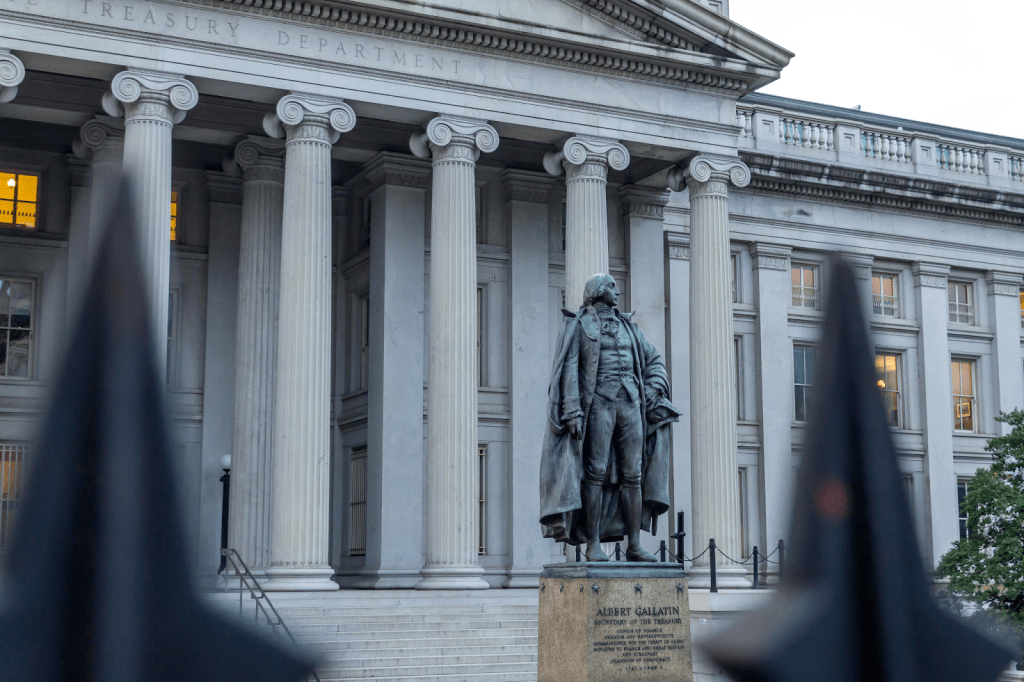

Furthermore, there is negative public sentiment towards certain tax laws applicable to private equity firms and other alternative asset managers. For instance, in the traditional 2-and-20 private equity pricing model, with a flat 2% management fee and an additional 20% fee (or “carry”) on profits, the carry is taxed under the capital gains instead of income. Since the former is capped at just over 20% while the latter may reach almost double that, some critics, including the team behind “Pirate Equity,” have questioned the fairness of the Internal Revenue Service’s approach. They argue that private equity firms are not “paying their fair share” of taxes under the existing “tax loopholes” and “lax regulation.”

Yet increasingly, another view has begun to surface: that of private equity and other financial services firms as forces of good, driving innovation and stimulating economic growth. Nicolas Mackel, CEO of the financial and economic development agency Luxembourg For Finance, claims that there are “a number of benefits to Luxembourg’s society that stem from the significant presence of many financial services firms.” This is evident from the composition of Luxembourg’s GDP, with the financial services sector—which includes private equity—contributing approximately a fourth of Luxembourg’s value-added GDP. Further, over 130,000 jobs in Luxembourg were linked to the financial services industry at the end of 2021.

In an analysis by Ernst & Young, private equity generates value in six key ways: innovation, talent, increased capital access, infrastructure development, social impact, and financial performance. When a private equity firm acquires a majority stake in a business, it actively participates in the management of said business, reducing its overhead costs and streamlining its workflow. A PE firm’s acquisition not only benefits the business itself, allowing it to maximize its profits and continue to grow, but also makes an impact on the greater economy. Private equity investments boost creativity and innovation on an economy-wide level by stimulating the growth of acquired businesses; in Europe, over 70% of these businesses are small-to-medium enterprises. As a company grows, it typically requires a larger employee base, and this results in job creation. Furthermore, private equity firms have partnered with governments to build and finance public infrastructure projects like airports and roads.

Private equity has also emerged as a key player in Environmental, Social and Governance investing. This type of impact investing, aimed at maximizing sustainability and responsibility, uses strategic placement of capital to generate positive effects on the environment and other forms of social impact. This presents a win-win situation: profits can be realized while ethical business principles are upheld and progress is made towards United Nations Sustainable Development Goals, such as Affordable and Clean Energy. According to a 2020 study by the Institut Européen d’Administration des Affaires, over $370 billion has been invested by private equity firms into ESG-focused funds.

Are the positive contributions of private equity enough, however, to offset the negative effects of the job losses and bankruptcies? A 2022 Harvard Business Review article suggests there is room for improvement in this area. With an estimated $6.3 trillion in assets under management, the private equity industry is strategically positioned to augment its positive societal impact. Private equity firms’ direct control over their portfolio companies’ governance, as well as their complete access to their companies’ privileged information, grants them the ability to meaningfully incorporate sustainable business practices into their revenue models. The article points out that they should be capitalizing on this unique position, and to their credit, this process is beginning. The UN-backed organization Principles for Responsible Investment has reported that private equity and venture capital firms’ involvement as signatories—a way for organizations to publicly declare themselves committed to including ESG considerations in investment decision making—has quadrupled over the past half decade. Though only 28 of the 70 globally top-100 ranked American private equity firms have become signatories, the upward trend is encouraging, and hopefully suggestive of private equity’s future rise to the forefront of the sustainability in business movement. Furthermore, according to a study by Song Ma, assistant professor of finance at Yale, private equity firms were also able to stabilize a significant number of failed banks in the period after the 2008 financial crisis. Their investments directly saved the Federal Deposit Insurance Corporation, a government agency tasked with maintaining order in the U.S. financial system, a whopping $3.63 billion in resolution costs. This, along with the industry’s emerging emphasis on socially responsible investing, its ability to boost economic growth, and the innovation it makes possible, argues against its negative stereotyping—private equity may not be perfect, but it’s certainly no villain.

Leave a comment