By: Ethan Lamb

Inadequacies in healthcare are largely the fault of the increasing regulatory apparatus. Undoing these interventions would result in higher-quality insurance and lower costs.

In the first part of the healthcare series (available HERE), I addressed some of the regulatory framework responsible for preventing innovation and entrance into the market. However, there is an entire regulatory apparatus on the demand side which further undercuts the free-market system. Specious policies that are purportedly designed to fix the shortcomings of the free-market are actually aimed to fix problems that were created as a result of distortionary regulations. A simple implementation of simple economic theory regarding insurance could go a long way in reducing healthcare costs and expanding health insurance.

The Distorted Health Insurance Market:

A central issue with our healthcare market is the absence of a robust cash-market. More specifically, insurance is most effective when it lies on top of a healthy cash-market. That is, generic health expenses should be paid out-of-pocket, instead of being covered through a bloated insurance plan. Take car insurance for example- is it necessary to require health insurance to pay for routine oil changes? Thankfully, they do not. Because there is a cash-market system for oil changes, consumers are more price-sensitive because it is their own cash on the line, and this sensitivity ultimately drives down prices through competition. However, in health-care, the most rudimentary services are usually covered by insurance. Because the onus of negotiating deals is shifted to the insurance companies, consumers are left indifferent about the true cost of services. Economist John Cochrane explains, “Insurance functions best when it is a small part of a market, in which prices are set by marginal consumers paying cash and competitive businesses supplying them. With little price discovery left in healthcare, health insurers have to do all the price negotiation in a vacuum.” Such insensitivity to prices disincentives health-care companies to cut costs and lower prices.

Consequences of Employer-based Health Insurance:

A large part of why the cash-market is not robust is due to the enshrinement of tax-deductible employer-based health insurance. Employer-based health insurance emerged because firms realized the tax deductibility of health insurance allowed them to compensate their employees more efficiently by circumventing taxation. While well-intentioned, this exclusion in the tax code precipitated a myriad of unintended consequences which perverted the entire insurance market. Health Care expert Scott Atlas explains, “it [employer-based insurance] encouraged higher demand for care, regardless of cost, while distorting insurance into covering almost all services. Similarly, premium subsidies in the ACA and the tax credits proposed by the GOP artificially prop up high insurance premiums for bloated coverage that minimizes out-of-pocket payment. They prevent patients from caring about prices, thereby reducing the incentives for doctors and hospitals to compete on price.” Common sense posits that employers seek to minimize taxable compensation. Thus, employers choose to opt for the most expansive insurance plans. On the surface, all seems good. However, as explained earlier, the rapid growth of services covered by insurance invariably led to the collapse of the cash market. Consequently, the pernicious insensitivity to prices emerged.

The consequences of employer-based health insurance directly caused the pre-existing conditions debacle that is so widely-covered in health care debates. Because employer-based insurance dominates the market, the individual health insurance market has effectively collapsed. Rather than long-term, portable health insurance tailored to the individual, insurance is instead tied to the employer. Meaning that any unforeseen circumstances, whether it be a lost job or moving states, will result in losing the insurance plan. Thus, any illness picked up during the transition will markedly raise the insurance cost of the next plan.

The Unintended Consequences of the Affordable Care Act:

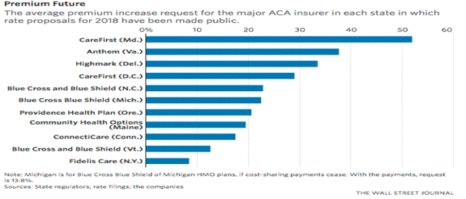

The Affordable Care Act (ACA) sought to resolve this pre-existing conditions issue in precisely the wrong manner by rejecting basic premises about insurance theory. For an insurance company to function properly, it must charge different rates because it is unable to determine who is likely to cost it more. If there were to be one fixed price for everybody, healthy individuals would exit the market because the cost of insurance would outweigh the cost of forgoing insurance. What the ACA did was preclude insurance companies from using information about preexisting conditions to differentiate the price. While noble in its intentions, the ACA, through regulatory fiat, manufactured an adverse selection crisis by mandating that individuals with pre-existing conditions be offered the same price as low-risk individuals. Predictably, the premiums for individual coverage more than doubled between 2013-2017 which prompted low-risk individuals to leave the market altogether. The preexisting conditions mandate also created perverse incentives by relieving the cost of forgoing health insurance until the individual becomes sick. If this scenario were applied to fire insurance, individuals would wait to purchase fire insurance until after the house is already burned down.

This trajectory is clearly unsustainable and explains why the cost of premiums has risen so dramatically in recent years. Such a phenomenon is referred to as a “death spiral.” Political analyst Yuval Levin summarized this process nicely back when the ACA was starting its rollout: “If the exchanges end up containing too many people in poor health and not enough people in good health, insurers could take massive losses in 2014 and be forced to dramatically raise premiums for 2015 plans to better price the risk they would be taking on. Those higher premiums would cause even more healthy people to avoid getting coverage, leaving the risk pool in even worse shape and so driving even further premiums hikes, and the cycle would continue.”

Elasticity of Demand:

In order to rectify the distortions in health care demand, a basic presupposition about healthcare must be addressed. A fatal misconception in healthcare policy is assuming that cost is inelastic. Certain procedures are more elastic than others, but at large, there is certainly a bent cost curve. John Cochrane demonstrates this with a hypothetical. He says “your doctor prescribed this MRI. You can have the MRI or you can have $1,000 in cash.” The patient ‘needs’ the MRI if he or she foregoes the cash and goes through with the MRI.” Many people would presumably forgo the MRI. Furthermore, the reality that medical procedures are elastic greatly undermines the notion that a cookie-cutter plan would satisfy everyone equally. In fact, the ACA included “essential mandates” that increased premiums by 10%. To go further, there are 2,270 state coverage mandates that include acupuncture and marriage therapy. Rather, certain plans ought to be offered at different prices and include a variety of choices, because people value such services differently.

Solution:

The first step to solving the health care demand issue is by eliminating the tax-deduction for employer-based health insurance. This step would revive the market for individual health insurance plans and pave the way for the emergence of individual health insurance plans that are portable, transferrable, and guaranteed renewable (meaning that insurance companies cannot drop a consumer if that consumer were to get sick). These plans would foster competition and effectively resolve the preexisting condition dilemma by not tying the insurance plan to the whims of an employer. The next step would be to repeal mandates from the ACA, including the preexisting conditions mandate. Not only because it would be largely unnecessary, but it would also allow insurance companies to offer different prices, preventing low-risk people from exiting the market and lowering premiums.

Furthermore, to help regain price sensitivity, high deductible insurance plans (HDPs) and health savings accounts (HSAs) must be expanded. An HDHP, as the name suggests, requires patients to pay a higher deductible for service, urging them to place a higher priority on the price of services. An HSA is a tax-sheltered savings account that is used to pay for non-catastrophic expenses, which Scott Atlas notes “form the bulk of medical care.” Atlas further cites a comprehensive economic study conducted by Amelia M. Haviland, Matthew D. Eisenberg, Ateev Mehrotra, Peter J. Huckfeldt, and Neeraj Sood from the National Bureau of Economic Research. This study found that, when patients utilized HDHPs and HSAs, the spending decreased by 15% annually. In addition, the study also concluded that the cost of care came down without harmfully impacting health outcomes. In short, by fostering price sensitivity and saving, the cost of healthcare can be driven down through competition.

Works Cited:

Image Source: https://actorsfund.org/services-and-programs/artists-health-insurance-resource-center

Cochrane, J. H. (2009, February 18). Health-Status Insurance: How Markets Can Provide Health Security. Retrieved from https://www.cato.org/publications/policy-analysis/healthstatus-insurance-how-markets-can-provide-health-security

Cochrane, J. H. (2013). After the ACA: Freeing the Market for Health Care. SSRN Electronic Journal. doi:10.2139/ssrn.2213027

Haislmaier, E. (n.d.). How Obamacare Raised Premiums. Retrieved from https://www.heritage.org/health-care-reform/report/how-obamacare-raised-premiums

Haviland, A., Eisenberg, M., Mehrotra, A., Huckfeldt, P., & Sood, N. (2015). Do “Consumer-Directed” Health Plans Bend the Cost Curve Over Time? doi:10.3386/w21031

Laszewski, R. (2017, August 03). Is Part of the Health-Insurance Market Entering a Death Spiral? Retrieved from https://www.nationalreview.com/2017/08/obamacare-death-spiral-exchange-enrollment-down-29-percent/

Levin, Y. (2017, October 10). An Insurance Death Spiral? Retrieved from https://www.nationalreview.com/corner/insurance-death-spiral-yuval-levin/

State Insurance Mandates and the ACA Essential Benefits … (n.d.). Retrieved from http://www.ncsl.org/research/health/state-ins-mandates-and-aca-essential-benefits.aspx

The Path To Affordable Health Care. (n.d.). Retrieved from https://www.hoover.org/research/path-affordable-health-care

Leave a comment